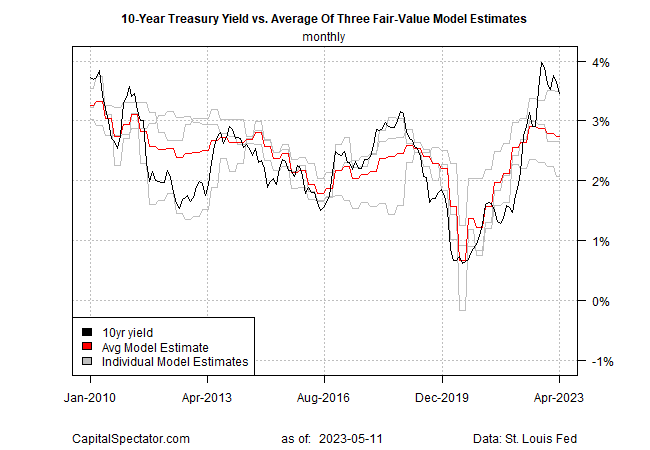

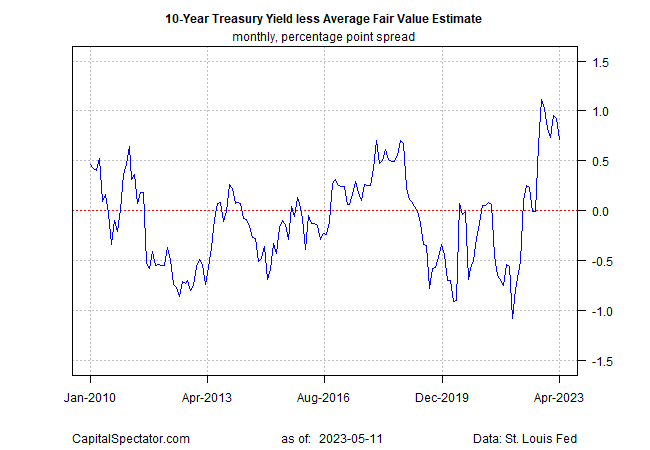

The wide spread between the US 10-year Treasury yield and CapitalSpectator.com’s lesser fair-value estimate continues to narrow, albeit slowly. As outlined on these pages in recent months, the model continues to project a lower market rate ahead. Timing is unknown, but today’s revised analytics reaffirm the forecast.

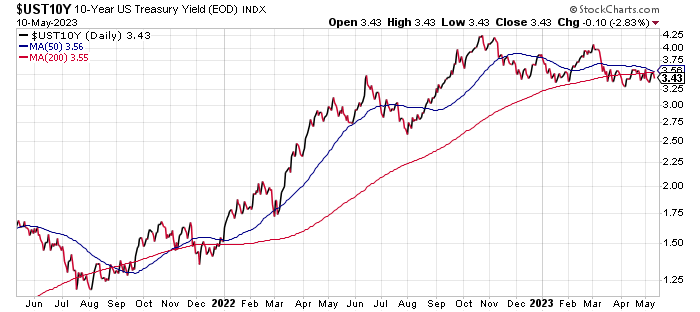

The 10-year yield continues to trade well below its peak, ending yesterday’s session at 3.43% (May 10). As recently as early March, the benchmark rate hit 4.08%. But as we discussed later that month, the fair-value model pointed to a lower market rate in the months ahead, and so far, that forecast remains intact in today’s update.

The current fair-value estimate is 2.75% for April, virtually unchanged from the previous month. The fair value is based on the average of the three models defined here.

The market rate is still well above the average estimate, but this spread continues to decline, albeit slowly. The gap eased to 71 basis points in April, a seven-month low.

The spread still looks set to narrow further. If inflation and economic activity turns substantially higher, the forecast could be undermined. But for the moment, the odds for those scenarios are unlikely for the immediate future.

The Federal Reserve is expected to provide a degree of support for a further narrowing of the spread. Fed funds futures are currently estimating a high probability that the central bank will pause its rate hikes at the next policy meeting on June 14.

“We expect the FOMC to maintain the federal funds rate at its current level for the foreseeable future and for inflation to slow further in the months ahead as supply pressures continue to ease and demand growth weakens,” Wells Fargo’s economics team wrote on Wednesday.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI