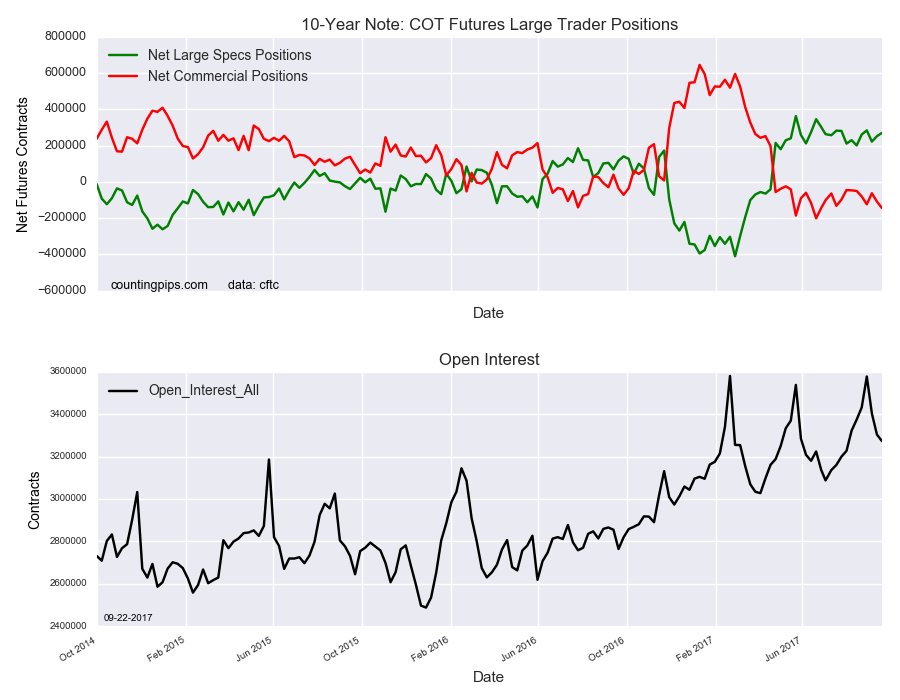

US 10 Year T-Note Futures Non-Commercial Speculator Positions:

Large treasury bond speculators raised their bullish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 270,120 contracts in the data reported through Tuesday September 12th. This was a weekly increase of 18,441 contracts from the previous week which had a total of 251,679 net contracts.

Ten-year note speculative positions, up two weeks in a row and at the highest level in four weeks, have now advanced for four out of the last five weeks and are above the +250,000 net position level for a second week.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -144,751 contracts on the week. This was a weekly drop of -36,404 contracts from the total net of -108,347 contracts reported the previous week.

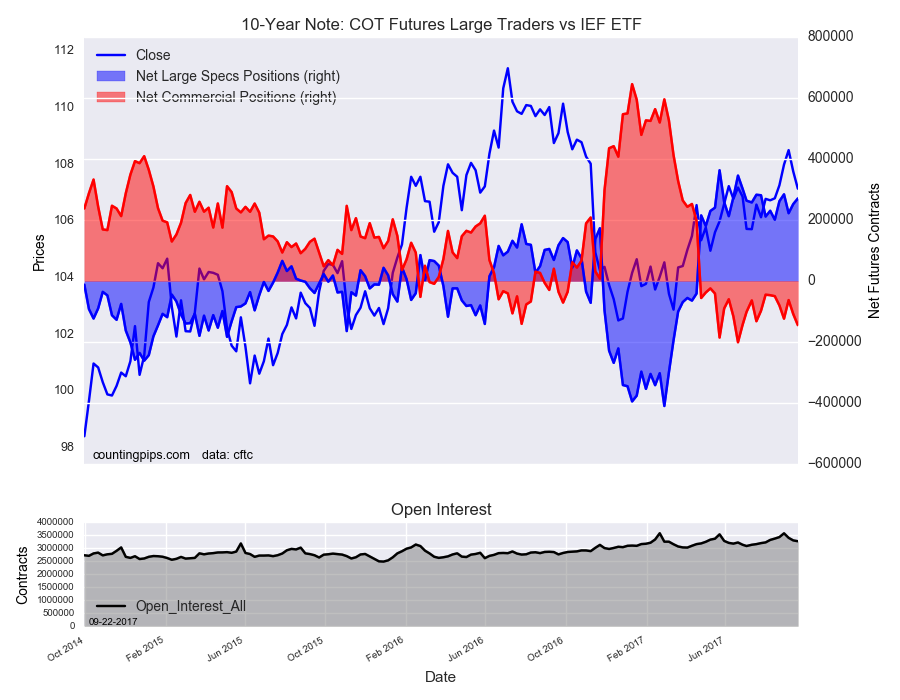

iShares 7-10 Year Treasury Bond (NASDAQ:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $107.15 which was a decline of $-0.61 from the previous close of $107.76, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI