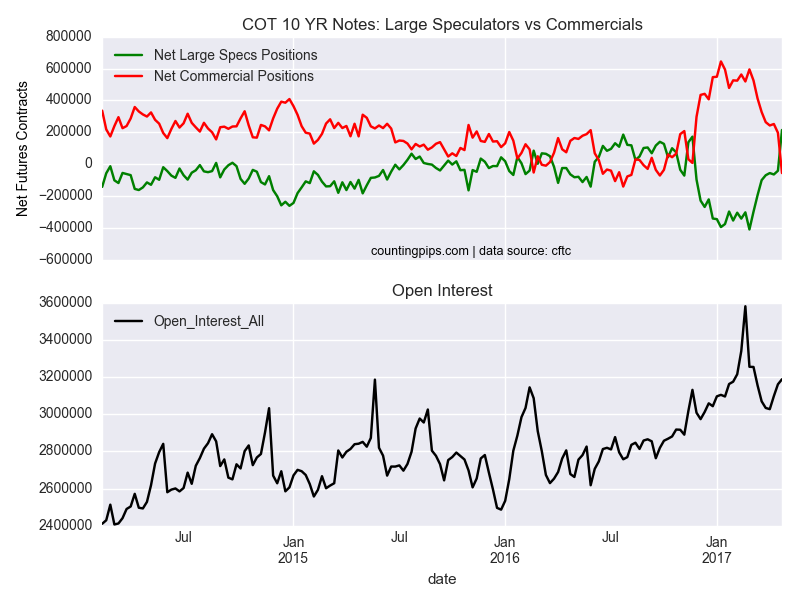

10 Year Treasury Note Non-Commercial Positions:

Large speculators and traders sharply increased their bets in favor of the 10-year treasury notes after being on the short side of this market for approximately the past five months, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of 214,642 contracts in the data reported through April 25th. This was a weekly jump of 255,942 contracts from the previous week which had seen a total of -41,300 net contracts.

The abrupt shift in the speculators positions follows a steady deterioration of their bearish bets after reaching an all-time record high in bearish positions of -409,659 net contracts on February 28th. Speculators now have a net long position for the first time since November 22nd.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -56,005 contracts last week. This is a weekly change of -253,008 contracts from the total net of 197,003 contracts reported the previous week.

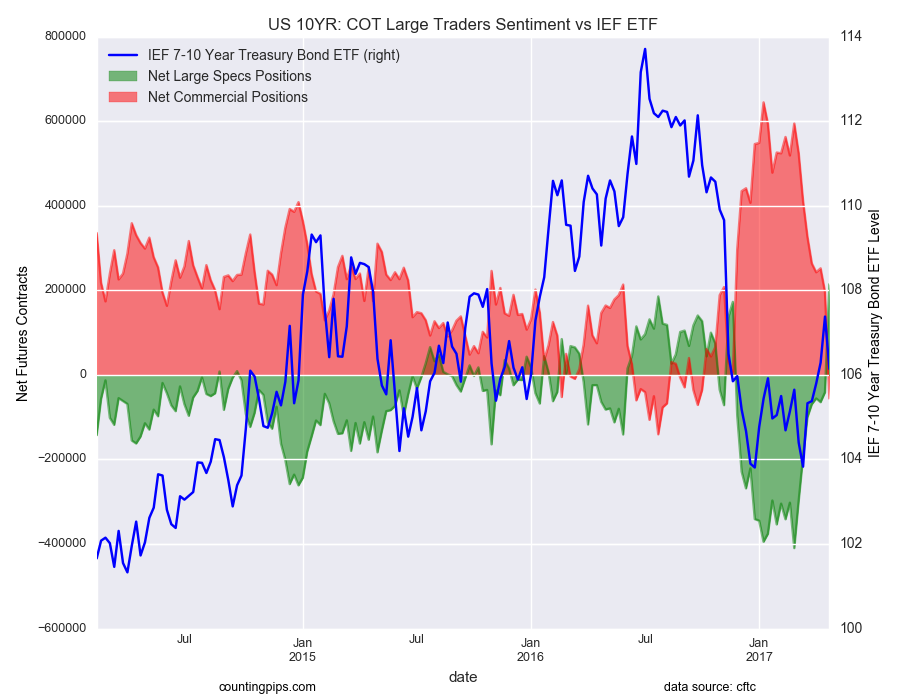

iShares 7-10 Year Treasury Bond (NYSE:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.14 which was a decline of $-1.24 from the previous close of $107.38, according to ETF market data.