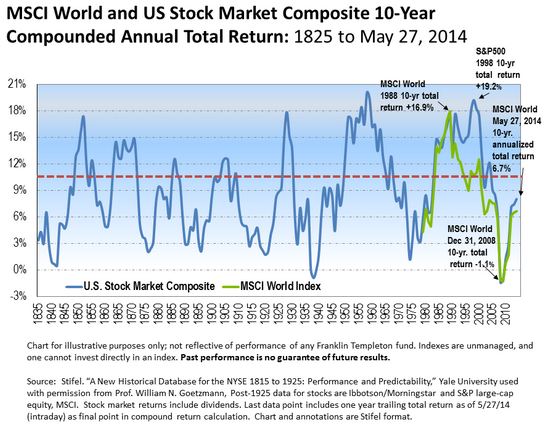

Franklin Templeton Investments published recent commentary on their positive view of equities both in the U.S. and in Europe. The entire article is a worthwhile read; however, one chart included in the write up was the one below showing 10-year annualized returns going back to 1825. As the chart shows, in spite of the strong bull market in equities around the world send the bottoming of the financial crisis in 2009, the compounded 10-year annualized return remains pretty far below average.

The market's recovery since the end of the financial crisis seems to have occurred almost without any significant pullback. As the above chart shows though, a pullback or correction would not be an uncommon occurrence. However, timing the market is difficult and technically speaking, further highs in equities seem more likely than not. A key to further equity market strength will be positive developments on the economic front. The coming shortened trading week will see a large number of economic reports release that should shed some light on the state of the U.S. economy.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI