Thursday, the S&P continued its downward slide that breached below the 1539.50 lows, which were made in early April. Our bullish scenario gets canceled since this price overlap violates the three basic Elliott rules. We mentioned many times before that a correction would be something normal to happen now and it seems though that the top is in at 1597 and a correction has started. Bulls were notified to be ready at any time to cover their longs as the first target of the correction is the 1480 area.

Lets now see the worrying signals that support the bearish scenario of a downward correction. First of all is the fact that the sequence of higher highs and higher lows is over.

The upward sloping channel is broken and it looks like the index is heading towards the 1500-25 area. 5 waves are most probably completed and it looks like sell in May and go away has come early this year. The most dominant scenario is to see a downward correction towards at least 1470-90 area.

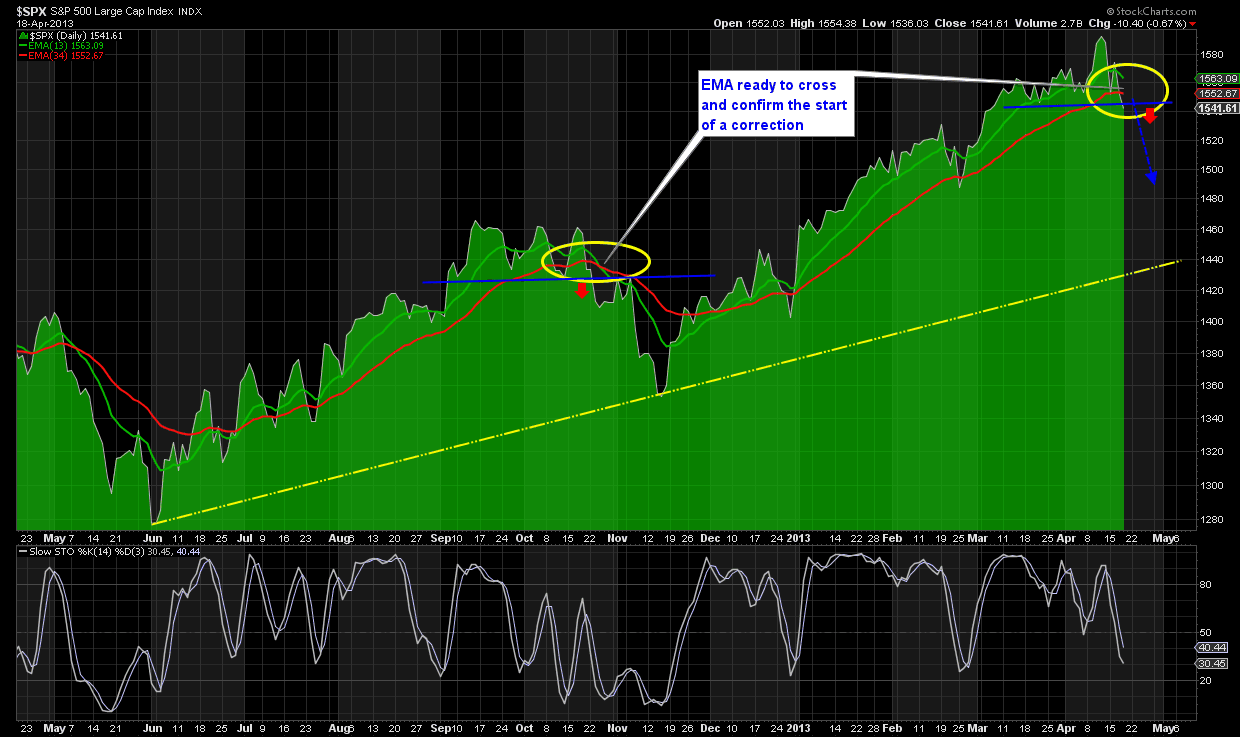

Another signal (lagging) is the crossing of the two EMA. The 13 day EMA is turning down and about to cross the 34 day EMA. This does not cancel a possible upward bounce towards 1555-65 area but it is most probable that it will meet great resistance and it will come back down. In general, this is a bearish signal that could confirm our worries.

As shown below, another worrying signal was the divergence from the Russell 2000 (IWM). Prices had broken earlier and despite the new high at 1597 that the S&P made, IWM just backtested the broken channel.

The completion of 5 waves is followed usually by a correction towards the 38% and 61,8% retracement. Although bulls may find this as bad news, I only have to note that this is the good scenario. What I mean is that after the expected correction that could last a couple of months, prices will start a new upward move. The bad scenario is the one were we just made a top similar to the one of 2007 and a big bear market is coming.

Whatever the end result, we are here to take advantage of every opportunity the market gives us, either long or short. Trading only one side is like walking with only with one leg….we need to be friends with the trend. Prices cannot rise all the time. It is natural and healthy to see a correction. Trend is changing to down and we need to adapt. Stop for short positions is the recent high at 1597. Upward corrections, if not impulsive, should be met with selling. I believe it is time to make a small correction.

Thank you for taking the time to read my new post. You can contact us if you need help with trading and you can see our performance from my trades I post in twitter and in our newsletters in the Premium Services page.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI