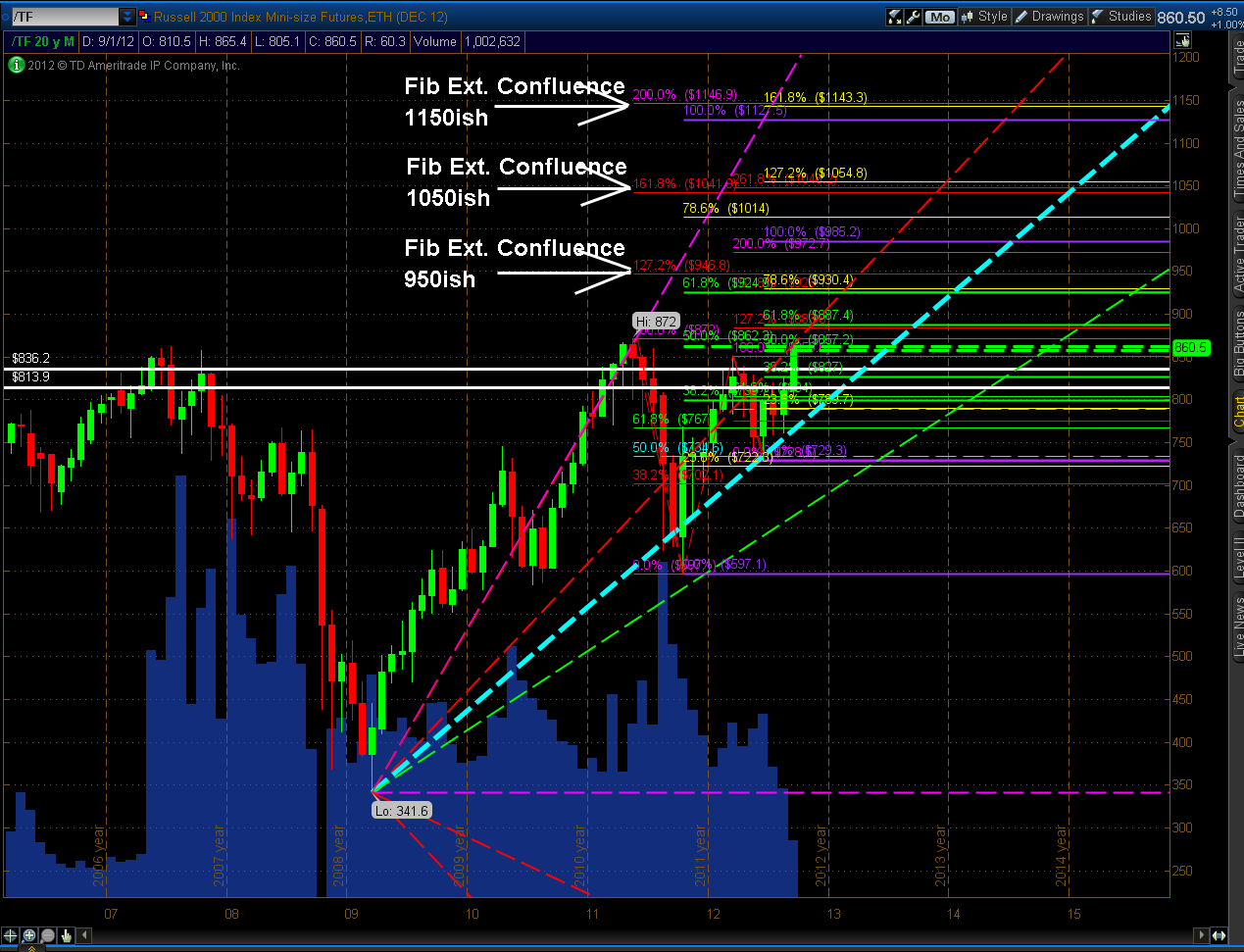

The Monthly chart below of the TF (Russell 2000 E-mini Futures Index) contains two Fibonacci retracement drawings, two Fibonacci Extension drawings, and a Fibonacci fanline drawing. I've selected the TF, as I consider it to be the "Canary in the Coal Mine" as either a leader/laggard of strength/weakness among the other E-mini Futures Indices (YM, ES & NQ).

Assuming the TF rallies and holds above its all-time high of 872, eventual projected major Fibonacci confluence resistance levels are 950ish, 1050ish, and 1150ish. The timeline for the TF to, potentially, reach these levels is, of course, unknown. However, if one were to assume that price holds above the 50% Fibonacci fanline (heavy broken blue line) (as it has held from the lows of 2009, thus far), and if it hugged the 40% fanline (red broken line), you would see that 950 would be reached by April 2013, 1050 would be reached by December 2013, and 1150 would be reached by August 2014.

For now, they serve as hypothetical targets, with the 50% Fibonacci fanline providing major support on any pullbacks, together with the other Fibonacci confluence levels. Price is currently just below its all-time high and is inside a web of Fibonacci confluence. It may bounce around for awhile before resuming its uptrend...alternatively, we may see an immediate strong push above, as mentioned in my last post, before it, potentially, consolidates or pulls back a bit to hold above what would become major support around 875.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.