Stocks dropped 10-points at the open yesterday, due to what the financial media claimed was weak earnings. But rather than rattle nerves, a sharp reversal erased those losses before lunchtime. While we continued to bounce around in the afternoon session, the S&P 500 finished the day well off those morning lows.

Once upon a time price-action like this was insightful. Running out of sellers so quickly after an unsettling open is often a strong 'buy' signal. But in our current market, we have to assume this is just more random noise and cannot base a trade off it. If anything, I’m more inclined to trade against this signal than with it given how quickly this market reverses.

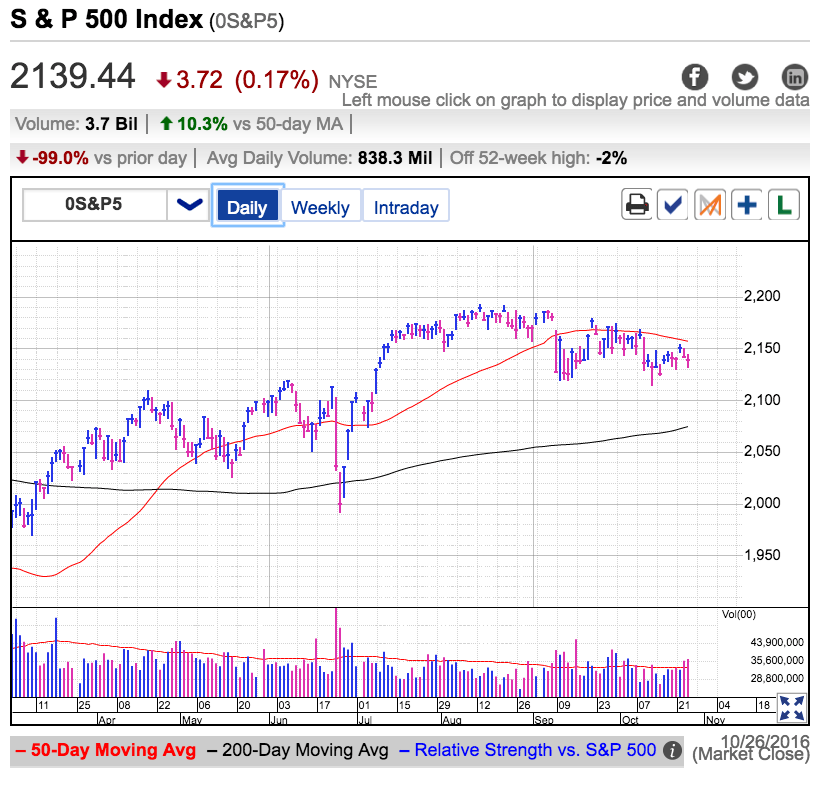

We remain inside the recent trading range and until the market shows us something new, we have to assume we are still playing by the same rules that have governed us since mid-summer. That means expecting directional moves to fizzle and reverse.

The thing to remember about stock market “rules” is they are only rules half the time. Sometimes we buy the breakout, other times we sell overhead resistance. A bearish lower-low looks just like a bullish double-bottom. Knowing what rule to apply when is the art of trading.

The first job of the trader is paying attention to the mood of the market. Are we in a buying mood? A selling mood? An indifferent mood? With this critical piece of information, we know which set of rules to apply. Currently we’re in an indifferent mood and that means ignoring traditional buy and sell signals.

It usually takes something significant to trigger a change in mood. Many times it is a dramatic and unsettling headline. Other times it is as simple as a change in the calendar as we transition from one quarter to the next.

I hoped going from the summer doldrums to the higher-volume fall trade would liven up our market and give us something to trade. Unfortunately that didn’t happen and now we need to look ahead for the next big thing to wake traders up. We are already a good chunk into the 4th quarter and 3rd quarters have not moved the needle. The election is the next big thing on the horizon and less than two weeks away. Following that is the Fed’s largely expected rate hike in November or December and institutional money managers repositioning for year-end. Hopefully one of these wild cards will pull us out of the trading range doldrums.

I will be shocked if the market trades lifelessly for the rest of the year, but the market has a nasty habit of giving us the thing we least expect. All we can do is wait and see.