Kiadis Pharma BV (AS:KDS) is developing T cell-based therapies to address the issues associated with haematopoietic stem cell transplantation (HSCT). The company is leveraging its Theralux technology to develop ATIR101 and ATIR201 as adjunct therapies to HSCT in leukaemia and thalassemia, respectively.

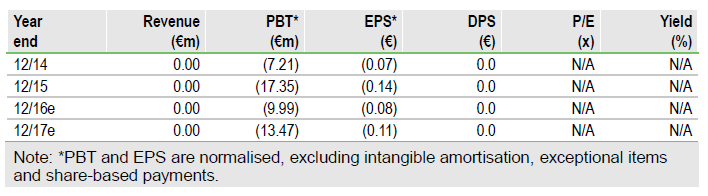

On the back of Phase II data, Kiadis is aiming for accelerated filing of ATIR101 with the European Medicines Agency (EMA) in Q117. A Phase III trial will start in H216. ATIR201 will start a Phase I/II trial in H216. Cash at end June 2016 was €23.7m, sufficient to fund operations until early 2018. We value the company at €327.3m or €27.1/share.

Looking to a fast path to market

Following ATIR101 Phase II data, Kiadis has decided to file for conditional approval with the EMA in Q117, setting a potential approval date in Q118. We believe it is possible that Kiadis may get approval given the precedent set by MolMed, which recently received Conditional Marketing Authorisation (CMA) from the European Commission on data from a small Phase II study that showed a one-year survival rate of 49% vs 37% for historical control.

The regulatory pathway is also clear in the US; the Phase III primary endpoint and active comparator arm have been defined after an end of Phase II meeting with the FDA. This Phase III trial is needed for full approval in both the US and EU.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.