Alcoa (NYSE:AA) reports its FQ2 ’15 results after Wednesday's market close to unofficially kickoff reporting season. Alcoa’s share price has continued to deteriorate leading into its result. Year-to-date (YTD) Alcoa’s stock has fallen -31.79% as compared to the S&P 500 index which has only depreciated 0.4%.

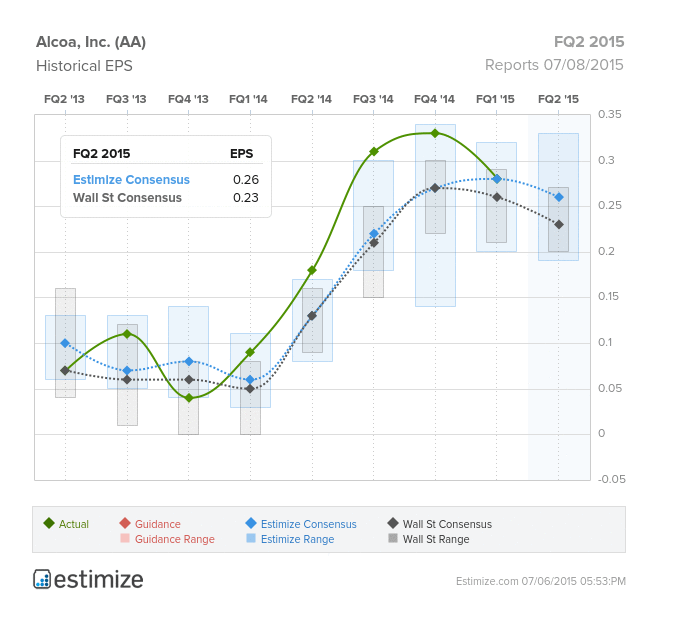

Estimize predicts an EPS figure of $0.26 and a revenue number of $5.883B. Wall Street analysts however, predict an EPS figure of $0.23 and revenues of $5.82B.

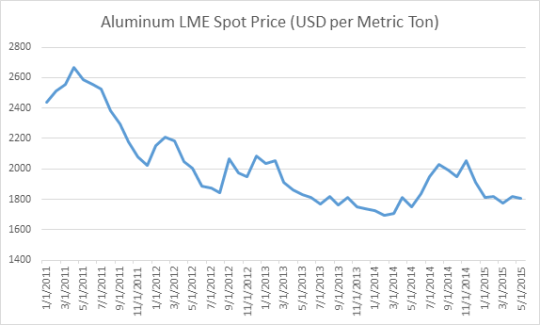

Alcoa has pursued an aggressive cost cutting campaign and continues to reduce capacity as alumina prices remain depressed. Recently, Alcoa announced to the market that they are permanently closing their Poços de Caldas primary smelter in Brazil. The closing of this smelter reduces Alcoa’s overall capacity by 96,000 metric tons to 3.4 million metric tons. The chart below depicts the Aluminum spot price weakness over the past four years.

Investors will watch how the company reacts to competitive threats from Chinese aluminum producers. The low-cost Chinese producers have had a destructive impact on the aluminum industry and this is only likely to worsen. Earnings and revenue estimates continue to be revised down leading up to Alcoa’s result. Unfortunately for Alcoa’s shareholders, cost cutting will most likely not be enough to stimulate earnings in a meaningful way. Alcoa needs an earnings beat and some positive outlook from management in order to generate some share price momentum.

When Alcoa kicks off reporting season on Wednesday, Investors and traders will have a keen interest in the comments and outlook from management. Market participants will be listening closely to the discussions surrounding future demand from the aerospace industry. Alcoa’s product mix places them in a solid position to benefit from a growing aerospace industry. Their acquisition of Firth Rixson will have a material impact on the company’s ability to service that industry and capitalize on future opportunities.