For more than a year, we’ve been watching the unfolding -- sometimes slow, sometimes rapid -- of a real collapse in the commodity space. As we’ve noted in previous letters, this collapse is partly cyclical -- the result of overcapacity built during a boom time, a process which has been repeating itself in commodities since time immemorial. The collapse is also partly secular -- the result of technological revolutions in the extraction of tight oil and gas, and of China’s once-in-an-economy shift as its center of gravity shifts from manufacturing to services.

That collapse, along with many other factors, has contributed to troubles throughout emerging markets and industrial production weakness worldwide. Jumpy market psychology in 2015 has meant that economic data points are seized on and interpreted with a negative spin. Thus, we have ended up with a drumbeat of pessimism pulling down market psychology.

We want to point out a particular problem with pessimism arising from disappointing manufacturing data.

Economies are generally divided into three parts: primary, secondary, and tertiary. Primary includes agriculture (and natural resource extraction, in some models). Secondary includes manufacturing. Tertiary includes services.

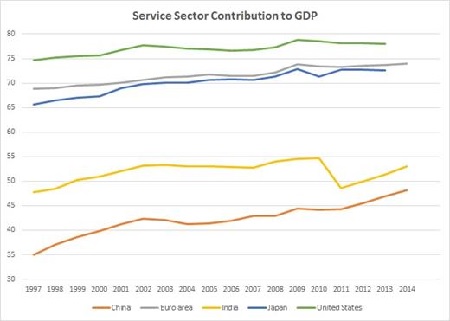

Source: World Bank

In developed countries, while the tertiary sector may be slowly trending up, it is generally between 70 and 80 percent. The chart above is notable for China’s rise; although the World Bank data are not yet up to date, China has crossed the 50 percent threshold as of 2015.

Therefore the story of a manufacturing slowdown in China is only half the story -- and the other half is a strong and accelerating services sector. Is this unusual? No -- it is the path taken by every world economy that has progressed from developing, to middle-income, to developed status.

The excessive focus on industrial, secondary sector data is a cultural hangover among financial analysts -- the memory of a time when manufacturing was indeed the strongest economic driver. To this day, financial news is dominated by constant manufacturing data releases -- which results in a selective overemphasis that subtly or not-so subtly de-emphasizes the most significant part of the global economy. The services sector gets short shrift.

It should not -- because services don’t follow industry in growth generation -- they lead it. This proposition is borne out by statistical analysis of sector growth rates since the 1950s. (It is counterintuitive, but on reflection, it makes sense; as services comprise a greater and greater proportion of GDP, expanding services will increase spending and stimulate manufacturing and construction.)

The U.S. ISM non-manufacturing index (the NIM) grew in October for the 69th consecutive month, and stands 5 points above its long-term average.

White Line: Non-manufacturing Index; Yellow Line: Manufacturing PMI Source: Bloomberg

Manufacturing PMI and been declining since the beginning of 2015, but the non-manufacturing index, the NMI, has been strengthening -- and again, it is the leader, not the follower.

If we give the torrent of manufacturing data a 20 percent weighting in our mind, and the services data an 80 percent weighting in spite of the fact that services data are not front and center in the financial media, we will form a more realistic view of the fundamental state of the U.S. and global economies.

Investment summary: Watch the services sector if you want to know how the economy is really doing. Services are much more important than the widely publicized manufacturing sector in every high and middle-income country. Part of the pessimistic psychology permeating markets is driven by an excessive emphasis on manufacturing data, which make up almost all of the highly visible data published in the media. With more than two thirds of global GDP derived from the services sector -- and now 50 percent of it in China -- the health of services deserves more weight in media communications about the world’s economic health. Services are strong, and strengthening -- and analysis shows that services strength leads manufacturing strength, not the other way around.