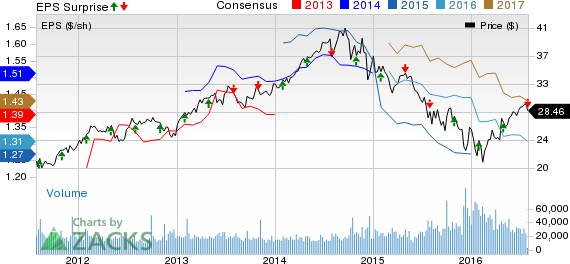

Enterprise Products Partners L.P. (NYSE:EPD) reported second-quarter 2016 adjusted earnings per limited partner unit of 27 cents, which missed the Zacks Consensus Estimate of 31 cents.

The bottom line also deteriorated from the year-ago quarterly earnings of 28 cents.

Quarterly revenues plunged to $5,618 million from $7,093 million in the year-ago quarter. The top line, however, beat the Zacks Consensus Estimate of $5,604 million.

Quarterly distribution at Enterprise Products Partners inched up 5.3% year over year to 40 cents per common unit. Adjusted distributable cash flow of $1,040 million provided coverage of 1.2x. The partnership retained $200 million in cash flow, thereby gaining financial flexibility to fund growth capital projects, reduce debt and decrease the need to issue additional equity.

Second-Quarter Segmental Performance

Gross operating income in the NGL Pipeline & Services segment rose to $719.1 million from $650.6 million in the year-ago quarter.

Onshore Natural Gas Pipeline and Services segment’s gross operating income decreased to $177.4 million from $191.4 million in the prior-year quarter.

Gross operating income from the Onshore Crude Oil Pipelines & Services segment declined 24.7% year over year to $177.4 million.

Gross operating income from the Petrochemical & Refined Product Services segment declined to $175.5 million from the year-earlier level of $181.3 million.

The Offshore Pipelines & Services segment had no contribution to the gross operating income in the second quarter. This was because Enterprise Products Partners closed the sale of its offshore Gulf of Mexico business on Jul 24, 2015. The Offshore Pipelines & Services segment had earned $44.3 million in the second quarter of 2015.

Financials

During the quarter, the partnership spent $884 million. Outstanding total debt principal as of Jun 30, 2016 was $23 billion. Enterprise Products Partners had consolidated liquidity of $4.7 billion, which comprised unrestricted cash on hand and available borrowing capacity.

Zacks Rank and Key Stock Picks

Currently, Enterprise Products Partners carries a Zacks Rank #3 (Hold).

Investors may consider better-ranked players in the energy sector like Vanguard Natural Resources, LLC (NASDAQ:VNR) , QEP Resources, Inc. (NYSE:QEP) and McDermott International Inc. (NYSE:MDR) . All these stocks sport a Zacks Rank #1 (Strong Buy).

ENTERPRISE PROD (EPD): Free Stock Analysis Report

MCDERMOTT INTL (MDR): Free Stock Analysis Report

QEP RESOURCES (QEP): Free Stock Analysis Report

VANGUARD NATURL (VNR): Free Stock Analysis Report

Original post

Zacks Investment Research