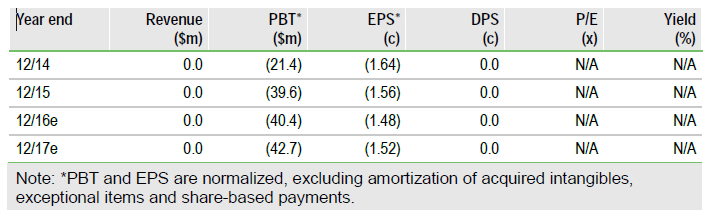

On 10 March Cerulean Ph (NASDAQ:CERU) reassured the market by reporting in-line full-year 2015 results, reiterating an expected cash runway into 2017 and confirming timelines for releasing clinical data for key pipeline projects in H116 are on track. Phase II data in renal cancer are expected by end June for its high-profile CRLX101, which uses its nanoparticle drug delivery system.

Critical newsflow concentrated into coming weeks

Management has reassured that the battery of clinic-related events for CRLX101 and CRLX301 expected in H1 are well on track. By 30 June Cerulean will report highly awaited top-line data (progression-free survival and overall response rates) from its Phase II trial of CRLX101 in combination with Avastin in advanced renal cell carcinoma. If positive, this will lead to the initiation of a Phase III study in metastatic renal cell carcinoma (mRCC) by year end. Other key upcoming news includes preliminary results for CRLX101 with weekly paclitaxel from the ongoing Phase Ib trial in relapsed ovarian cancer with the GOG Foundation, and additional CRLX301 data from a Phase I trial at the International Congress on Target Anticancer Therapies in April. Cerulean also plans to initiate a Phase IIa trial of CRLX301 in solid tumors (at a maximum tolerated dose of 75/mg2 once every three weeks) and dose first patients in a Phase Ib/II trial for the Cerulean-AZ-NCI collaboration. We forecast peak sales of $490m for CRLX-101 with Avastin in mRCC ($340m and $770m in follow-on indications of ovarian and rectal cancers respectively) and $550m for CRLX301.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI